![]()

Lehman Brothers (September 15, 2008) filed the largest bankruptcy in U.S. history

Subprime mortgage crisis (2007-2008)

the Iranian Oil Bourse (September 2006)

the NYSE's governing board voted to acquire rival Archipelago (December 6, 2005)

and become a for-profit, public company. It began trading under the name NYSE Group on March 8, 2006

Mitsubishi UFJ Financial Group (October 1, 2005)

at the traditional meeting of G8 finance ministers before the summit (June 11, 2005) agreement was reached

to write off the entire US$40 billion debt owed by 18 Highly Indebted Poor Countries to the World Bank,

the International Monetary Fund and the African Development Fund.

the European Union withholding tax (July 1, 2005)

the Make Poverty History campaign (2005)

the Security and Prosperity Partnership of North America (March 23, 2005)

Marketing 2.0 (2005)

Turkish new lira (January 1, 2005)

the Corporation (2003)

TecDAX (March 24, 2003)

the Euro (2002) was launched as physical coins and banknotes in the following 12 european countries: Austria,

Belgium, France, Finland, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain

Enron went bankrupt (December 2, 2001)

the Doha Development Round (2001)

the International Accounting Standards Board (2001)

Euronext (September 22, 2000)

BNP Paribas (May 23, 2000)

Hong Kong Stock Exchange (2000)

the Bill & Melinda Gates Foundation (2000)

Shanghai Stock Exchange (2000)

No Logo (Jaunary 2000) by Naomi Klein

the Euro (1999) was introduced to world financial markets as an accounting currency

Jubilee 2000 (1998)

PayPal (1998)

the dot-com frenzy (1998)

UBS AG (June 1998)

the European Central Bank (June 1, 1998)

the Microsoft anti trust case (May 1998 - November 2001)

Citigroup was formed by a merger (April 7, 1998) of Citicorp and Travelers Group

Euro Stoxx 50 (1998)

Eurex (1998)

Borsa Italiana (January 2, 1998)

the Ruble was rebased (January 1, 1998)

Russian financial crisis (1990s)

Online banking (199?)

the Tobin tax (1997)

Bowie Bonds (1997)

Exchange Electronic Trading (1997)

the Asian financial crisis (1997)

eBay (September 4, 1995)

the WTO (January 1, 1995) was created to replace the General Agreement on Tariffs and Trade

NAFTA (January 1, 1994) took effect

debit cards (19??)

Interac (1994)

TRIPs (1994)

Maestro (199?)

the European Union (1992) lifted barriers to internal trade in goods and labour

Buy Nothing Day (1992)

Frankfurter Wertpapierbörse AG (1990)

the FATF (1989)

the national Debt clock (1989)

Dax (1. Juli 1988)

Solidaridad launched "Fair trade" labeling (1988) with the sale of Mexican

coffee which was certified to meet ethical standards of sustainable development

the Indian Gaming Regulatory Act (1988)

Black Monday (October 19, 1987)

the Carlyle Group (1987)

PLUS (1986)

the Blackstone Group (1985)

the Gramm-Hollings Deficit Reduction Act (1985)

the value chain (1985) was described and popularized by Michael Porter

Costco (1983)

the Woodstock of Capitalism (19??)

Bloomberg L.P. (1981)

emerging markets (1980s)

Management information system (1980s)

junk bonds (1980s)

e-commerce (1980s - present)

Special Economic Zones (1980)

the International Star Registry (1979)

the Latin American debt crisis (1970s-1980s)

the Grameen Bank (1976)

Visa (1976)

negative income tax (1975)

Marsh’s Supermarket in Troy, Ohio (June 1974) was the first to use the bar-code for scanning groceries

the Financial Accounting Standards Board (1973)

the petrodollar (1973)

the world oil shock (October 1973)

Money (March 2, 1973) by Pink Floyd

Swift (1973)

the Greeks (1973)

Sequoia Capital (1972)

cross border leasing (1970s)

Supply-side economics (1970s)

Richard Nixon announced (August 15, 1971) that the US dollar would

no longer convert to gold effectively ending the Bretton Woods system

Nasdaq (1971)

Nikkei (1971)

the World Economic Forum (1971)

Electronic article surveillance (1970s)

Abbie Hoffman (August 24, 1967) and several friends threw dollar bills from the visitors' gallery

onto the floor of the New York Stock Exchange, resulting in a near-riot as traders scrambled for the cash

MasterCard (1967)

the first electronic ATM (June 27, 1967) was installed in Enfield Town in North London by Barclays Bank

the Barclaycard (1966) was the first credit card introduced in the UK

the United Nations Conference on Trade and Development (December 30, 1964)

World Food Programme (1963)

FTSE (1962)

OPEC (1961)

the European Free Trade Association (May 3, 1960) was established

the International Development Association (1960)

Oxfam opened the first Worldshop (1959) retailing foreign goods under fair trade principles

the European Investment Bank (1958)

John Kenneth Galbraith (1958) published "the Affluent Society"

Deutsche Bundesbank (1957)

the S&P 500 (1957)

Milton Friedman's Restatement of the Quantity Theory published (1956)

this triggered off the development of modern monetarism

International Finance Corporation (1956)

Berkshire Hathaway (1955)

the Fortune 500 (1955)

the Chase Manhattan Bank (1955)

Value added tax (1954)

United Nations System of National Accounts (1953)

OppenheimerFunds (early 1950s)

Secrets of the Federal Reserve (1952) by Eustace Mullins

Diners Club (1950) invented the charge card, a forerunner of the credit card

the European Payments Union (1950-1958) was set up by the Organization for European Economic Co-operation. The

15 members were able to mutually offset deficits and surpluses up to the limits of their quotas which were set according to their

share of world trade. By 1958 most European currencies were sufficiently convertible for the payments union to be terminated

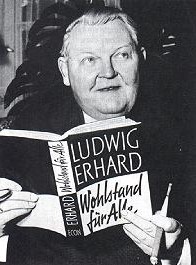

the Wirtschaftswunder (1950)

forwards (19??)

Hedge funds (1949)

the Renminbi (1949)

the General Agreement on Tariffs and Trade (1948)

the International Trade Organization's charter was agreed on (1948) at the UN

Havana conference on Trade and Employment, but was blocked in the U.S. Senate

the Organization for European Economic Cooperation was formed (1948) its initial purpose is to distribute

Marshal aid effectively. It also broadens the existing bilateral payments systems into wider multilateral clearings

Cheaper by the Dozen (1948) by Frank Bunker Gilbreth, Jr. and Ernestine Gilbreth Carey

the Indian rupee (1947)

Scrooge McDuck (1947)

the Marshall Plan or European Recovery Programme (1947)

venture capital (1946)

IBRD (1946)

the World Bank (1946)

the International Monetary Fund (1946)

money order (19??)

Hungary suffered from the world's worst ever hyperinflation (1944-1946)

the Bretton Woods system (July 1944) of international economic management established the rules for

commercial and financial relations among the world's major industrial states. The meeting of 730 delegates from

all 44 Allied nations gathered at the Mount Washington Hotel, situated in the New Hampshire resort town

of Bretton Woods established the International Bank for Reconstruction and Development (later divided into

the World Bank and Bank for International Settlements) and the International Monetary Fund

the Pareto principle (1941)

the shopping cart (June 4, 1937)

the Fort Knox Bullion Depository (1936)

mortgages (1934)

the United States Securities and Exchange Commission (1934)

Interregional and International Trade (1933) by Bertil Ohlin

Legalization of gambling in Nevada (March 19, 1931)

Britain abandoned the gold standard (1931) this marked the beginning of the move from classical to Keynesian economics. The

Commonwealth (except Canada), Ireland, Scandinavia, Iraq, Portugal, Thailand, and some South American countries follow Britain off gold

the Bank for International Settlements (1930)

the Smoot-Hawley Tariff Act (June 17, 1930)

Fortune magazine (1930)

the Great Depression (1929-1939) was a massive global economic recession

Black Tuesday (October 29, 1929)

Black Thursday (October 24, 1929)

Union Banking Corporation (1924-1942)

mutual funds (1924)

the Decline of the West (1923) by Oswald Spengler

the hyperinflation in

Germany (1923-1924) came about when by 1923 the Weimar Republic could no longer afford to maintain the reparation

payments for world war one as stated in the treaty of Versailles and the new government defaulted on payments. In response,

French and Belgian troops occupied the Ruhr region, Germany's most valuable industrial area at the time, taking control of the

mining and manufacturing companies in January of 1923. Strikes were called for, and passive resistance was encouraged. The

strikes had to last for eight months, which caused the German economy to suffer. Since striking workers also had to be paid

by the state, additional currency was printed, which fuelled a period of hyperinflation. The value of the Mark declined from 4.2

per US dollar to 1,000,000 per dollar by August 1923 and 4,200,000,000,000 per dollar on November 20. On December 1,

a new currency was established at the rate of 1,000,000,000,000 old marks for 1 new mark, the Rentenmark

the Curb Exchange (1921) was moved inside and became the American Stock Exchange

Kondratiev waves (1920s)

the Wall Street bombing (September 16, 1920)

Keynes published his Economic Consequences of the Peace (1920) in which he argued

against German war reparations and in favour of mutual cancellation of Allied war debts

the Prohibition (January 16, 1920 - 1933)

Communism (1917)

Trading with the Enemy Act (1917)

self-service grocery stores (1916)

Merrill Lynch & Co. (1915)

charge cards (1914)

the Federal Open Market Committee

Fitch Ratings (December 24, 1913)

the Federal Reserve Act (December 24, 1913) created the Federal Reserve System

the Rockefeller foundation (May 14, 1913)

the Sixteenth Amendment (February 3, 1913) authorized income taxes in their present form, in the US

the Supreme Court broke up Standard Oil (1911)

Moody's (1909)

the US Aldrich-Vreeland Act (1908) was a response to the panic of the previous year. It allowed groups of a minimum

of 10 national banks to form National Currency Associations to issue temporary currency. The act also set up a National

Monetary Commission which authorized 42 separate reports, most of which contained studies of foreign banking systems

the Kellogg School of Management (1908)

Harvard Business School (1908)

the Panic of (1907) prompted the United States Congress to form the Federal Reserve System

the United States Steel Corporation (1901) was the world's first billion-dollar corporation

Basil Zaharoff (1900s)

the Gold Standard Act (1900)

the Dow Jones Industrial Average (May 26, 1896)

J.P. Morgan & Co (1895) was forced in the 1930s by the Glass-Steagall Act to split into two companies:

J. P. Morgan (a commercial bank) and Morgan Stanley (an investment bank). After a 1959 merger J. P.

Morgan became Morgan Guaranty Trust, but ten years later it established a bank holding company called

J.P. Morgan & Company as its parent. By the late 1990s, when it was acquired by Chase Manhattan, J.P.

Morgan had turned itself into an investment bank too

minimum wage laws (1894)

the partial equilibrium supply and demand economic model

Praxeology (1890)

Principles of Economics (1890) by Alfred Marshall

traveler's cheque (late 19th century)

Psychological pricing (late 19th century)

the Wall Street Journal (July 8, 1889)

the Financial Times (January 9, 1888)

Methodenstreit (late 1880s - early 1890s)

New York Mercantile Exchange (1882)

American Express launched its money order business (1882) to compete with the US Post Office's money orders

die Kaiserliche Botschaft

(17. November 1881) gilt als Ursprung der Deutschen Sozialversicherung.

Sie entstand auf Initiative des Reichskanzlers Fürst Otto von Bismarck unter der Regentschaft Kaiser Wilhelm I.

the first modern coin-operating devices (early 1880s) were

vending machines that dispensed post cards introduced into London, England

Munich Re (1880)

Allianz AG (1880)

the cash register (1879) was invented by James Ritty

the Tokyo Stock Exchange (May 15, 1878)

the general equilibrium theory (1874) was expounded in Elements of Pure Economics by Léon Walras

the Long Depression (1873-1896)

the Scandinavian Monetary Union (1873-1924) was formed by Denmark, Sweden and Norway

under the US Coinage Act (1873) the silver dollar ceased to be the standard of

value. Thus the US was virtually on the gold standard, in practice if not in law

after becoming a united country, Germany (1873) adopted the Mark as their common currency, based on the gold standard

Neoclassical economics (1871)

Carl Menger's Principles of Economics (1871)

Western Union introduced its money transfer service (1871)

with the Japanese Currency Act (1871) a national mint was established at Osaka and the decimal system of yen and sen was introduced

after the Franco - Prussian War (1870-1871) the victorious Germans forced France to pay a huge indemnity of 5 billion francs.

The money is raised easily by a loan which is more than 10 times oversubscribed. This experience partly explains French reliance

on borrowing in preference to taxation in the First World War and French insistence on German reparations afterwards

dollar stores (1870)

Standard Oil (1870)

Goldman Sachs (1869)

the Black Friday crisis of (September 24, 1869)

Kuhn, Loeb & Co (1867)

the United States purchased Alaska (April 9, 1867) from Russia for $7,200,000 ($90,000,000 approx in 2003)

.jpg)

Das Kapital (1867) by Karl Marx

the Latin Monetary Union (1865-1926) comprised France, Italy, Belgium, Switzerland, and later Greece. The gold and silver

coins of each country are legal tender throughout the union. The union has faded away by the 1920s before its formal ending.

Jacob H. Schiff (1865) moved to the United States

Swiss Re (December 19, 1863)

the National Bank Act (1863)

the Homesteads Act (May 20, 1862)

the Commissioner of Internal Revenue (1862)

the Legal Tender Act (1862)

the Toronto Stock Exchange (1861)

Crédit Agricole founded (1860) its primary function is the supply of credit for French agriculture. The Crédit Agricole

develops into one of the world's largest banks. (During the early 1980s it was the largest, and in 1991 the sixth largest)

Credit Suisse (1856)

department stores (1852)

the Swiss franc (1850)

the Austrian School (mid 19th century)

the Historical school of economics (mid 19th century)

credit unions (19th century) were founded by Friedrich Wilhelm Raiffeisen

futures (1848)

Chicago Board of Trade (1848)

the Bank Charter Act (1844) was an Act of the Parliament of the United Kingdom, passed under the

government of Robert Peel, which restricted the powers of British banks and gave exclusive note-issuing

powers to the central Bank of England. This marked the beginning of the classic gold standard of the 19th century

The Economist (1843)

the Manchester Anti-Corn Law League was formed by men such as Richard Cobden, John Bright,

Sir David Roche and Charles Pelham Villiers and they battled for free trade in and out of Parliament

wire transfers (18??)

Researches on the Mathematical Principals of the Theory of Wealth (1838) by Antoine Augustin Cournot

the Gold rushes (1838-1898)

August Belmont immigrated to New York City (1837) after becoming the

American representative of the Rothschild family's banking house in Frankfurt

the Panic of (1837)

the Specie Circular (1836)

the safe (1835)

the Nullification crisis (1828)

the Tariff of Abominations (1828)

the Arcade in Providence, Rhode Island (1828) introduced the concept of indoor multi-vendor shopping to the United States

the Ecole Supérieure de Commerce in Paris (1819) was the first business school

On the Principles of Political Economy and Taxation (1817) by David Ricardo

Britain adopted the gold standard for the pound (1816) for centuries earlier silver

had been the standard of value. The pound was originally an amount of silver weighing a pound

the Rothschild banking family of France was founded (1812) in Paris by Jacob Mayer Rothschild

revenue stamps (19th century)

co-ops (19th century)

condominium ownership (1804)

the Louisiana Purchase doubled the size of the United States (1803) Napoleon, being short of cash, offered

to sell Louisiana to the United States for 15 million dollars. Two British banks, Barings and Hopes, agreed

to lend the money to the US government and, despite the wars, transfer it to Napoleon

the London Stock Exchange (1801)

the Dutch East India company (1799) formerly the world's largest company went bankrupt, partly due to the rise of competitive free trade

income tax (1799)

An Essay on the Principle of Population (1798) by Thomas Malthus

the Rothschilds expanded into Britain (1798) the Rothschilds banking house originated in medieval Frankfurt on Main.

In 1798 Nathan Rothschild was sent to Manchester to deal in the cotton industry. His banking operations grew rapidly

during the Napoleonic Wars, making full use of his family's international network of couriers

the Franc (1795)

with the US Coinage Act (1792) the Dollar was adopted as the unit of account in the United States, based on a bimetallic standard,

subdivided into 100 cents. Foreign coins are supposed to lose their status as legal tender within 3 years of the US coins coming into circulation

outside of 68 Wall Street (May 17, 1792) the Buttonwood Agreement,

which established the NYSE, was signed by twenty-four stock brokers

the Bank of North America (January 7, 1782)

the cost-of-production theory of value

An Inquiry into the Nature and Causes of the Wealth of Nations (1776)

the United States began issuing "Continental Currency" (1775)

building societies (1775)

the Boston Tea Party (1773)

Christie's (1766)

the National Gain (1765) by Anders Chydenius

the Sugar Act (April 5, 1764)

An Essay on (the Nature of) Commerce in General (1755) by Richard Cantillon was published posthumously

the first savings and loan association (1749) opened in Germany

Sotheby's (March 11, 1744)

the labor theory of value (1729)

the Mississippi Company (1717)

the South Sea Bubble (1711-1720)

the Statute of Anne (1709) was the first copyright law in the Kingdom of Great Britain

the triangular Atlantic trade (1700-1808)

flea markets (late 17th century)

the Bank of England (1694)

Barclays (1690)

the Massachusetts Bay Colony (1690's) issued the first permanently circulating banknotes

Life insurances (late 17th century)

Lloyd's Coffee House (1688)

Jonathan's Coffee-House (1680)

Colbertism (1665)

the first banknotes were issued by Stockholms Banco (1660) a predecessor of the Bank of Sweden

the tulip mania (1636-1637)

the Virginia Company (1606)

Mare Liberum (1604) was published by Hugo Grotius

stocks (1602)

the Dutch East India Company (March 20, 1602) was the first

multinational corporation and the first company to issue stocks in the world

Gresham's Law (15??)

the Royal Exchange (1571) was officially opened by Queen Elizabeth I

the pound sterling (1561)

asiento (1543-1834)

Calvinism (1536)

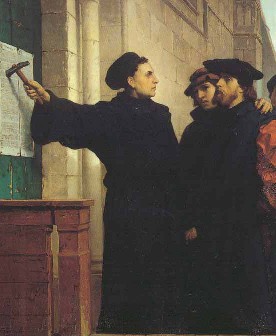

Pope Leo X offered indulgences for those who gave alms to rebuild St. Peter's Basilica in Rome (1517) a situation that took on the

appearance of "selling indulgences." The aggressive marketing practices of Johann Tetzel in promoting this cause provoked Martin

Luther to write his 95 theses, protesting what he saw as the purchase and sale of salvation.

Mercantilism (1500-1750)

Yapese stone money (ca 1500)

the Medici Bank (1397-1494)

the Bruges Bourse (1309)

Casinos (14th century)

the first recorded Trial of the Pyx (1282)

to help finance his war to conquer Wales, Edward I taxed the Jewish moneylenders (1275) however, the cost of Edward's ambitions

soon drained the money-lenders dry. When the Jews could no longer pay, the state accused them of disloyalty. Already restricted to

a limited number of occupations, Edward furthermore abolished their right to lend money at interest with the Statute of Jewry, 1275,

and eventually restricted their extra-curricular movements and activities. This Statute also decreed ..."that each Jew after he shall be seven

years old, shall wear a badge on his outer garmet that is to say in the form of two tablets joined of yellow fait {felt} of the length of six inches

and the breadth of three inches." In the course of King Edward's persecution of the Jews, he arrested all the heads of Jewish households.

The authorities took over 300 of them to the Tower of London and executed them, while killing others in their homes. Finally, in 1290,

the King banished all Jews from the country, by the Edict of Expulsion

the Florentine gulden (1252)

double entry bookkeeping (12th century)

the Hanseatic League (1157)

the Danegeld (856)

Constantine issued a new gold coin (309) the Solidus, which continued to be produced

in the Eastern Roman Empire unchanged in weight or purity for the next 700 years

Diocletian abdicated voluntarily (305) although his currency reform and prices and incomes policy failed, his

other reforms of the Roman administration, including the world's first system of annual budgets, were more successful

Christ drove the money changers out of the Temple in Jerusalem (c. 30)

lotteries (second century bc)

when the Gauls attacked Rome (390 bc) the cackling of geese in the capitol, where the city's reserves

of money were kept, alerted the defenders. The grateful Romans built a shrine to Moneta, the goddess

of warning, and from Moneta the words money and mint are derived

on the Silk route (400 bc) trade began mostly with lapis

lazuli, later also jade and silk became goods of exchange

sale on commission

the world's first bimetallic coinage (550 bc) was introduced during the reign of

Croesus when the Lydians began to produce coins of pure metal instead of electrum

Thales (beginning of the 6th century bc)

the use of coins spread rapidly from Lydia to Greece: Aegina (c. 595 bc), Athens (c. 575 bc), and Corinth (c. 570 bc) started

to mint their own coins. Prior to the introduction of coinage the Athenians had used iron spits or elongated nails as money

Coins were invented in Lydia (around 660 bc)

the Code of Hammurabi (1780 bc) included laws regulating the first banking operations in history, where

the royal palaces and temples provided secure places for the safe-keeping of grain and other commodities.

Receipts came to be used for transfers not only to the original depositors but also to third parties

the Tithe (1900 bc)

Cappadocian rulers guaranteed the quality of silver ingots (2250-2150 bc) the state guarantee, probably

of both the weight and the purity of her silver ingots, helped their wider acceptance as money

grain (9000 bc)

cattle (9000 bc)